The Often-Overlooked Aspects of Lifestyle Audits in Corporate Environments

This paper explores ten often-ignored areas that corporate lifestyle audits MUST examine — from luxury club memberships to social media signals, and even third-party asset ownership. Packed with real-world case studies and actionable insights for executives across all industries.

- Why spouses and dependents shouldn’t be excluded

- How perks, ghost assets, and rentals distort the truth

- What digital breadcrumbs and weekend spending reveal

Read the full article to ensure your fraud detection strategy is one step ahead.

Executive Summary

In an era of heightened corporate governance and anti-fraud measures, lifestyle audits have emerged as a proactive tool to detect misconduct. A lifestyle audit examines whether an employee’s living standard is commensurate with their known income, flagging any unexplained wealth as a potential red flag. Executives often focus on obvious financial records, but there are many subtle lifestyle factors that can reveal hidden risks. This paper highlights ten often-overlooked aspects of lifestyle audits that organisations should consider:

- Beyond Bank Statements – Employee Asset Ownership: Scrutinise assets like homes, vehicles, and investments, not just bank accounts, to uncover red flags hidden outside traditional financial statements.

- Invisible Perks – Unmonitored Benefits: Recognise that company-paid perks or vendor gifts (travel, expense accounts, etc.) can inflate an employee’s lifestyle without directly boosting their salary.

- The Travel Trap – Dubious Business Trips: Analyse business travel patterns for anomalies, such as excessive or luxury trips that lack clear business justification.

- Weekend Spending – Off-Hours Lifestyle Clues: Observe high spending during weekends or holidays (expensive leisure activities, parties, etc.) which may indicate income sources beyond the pay check.

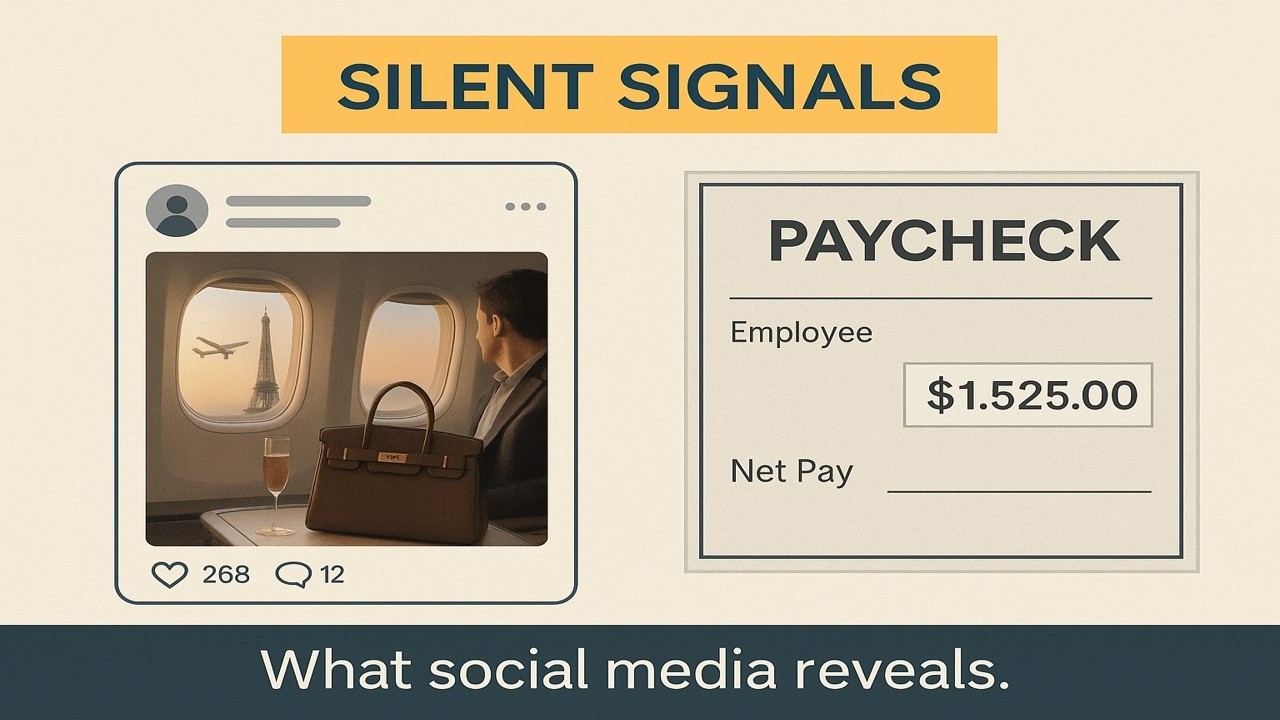

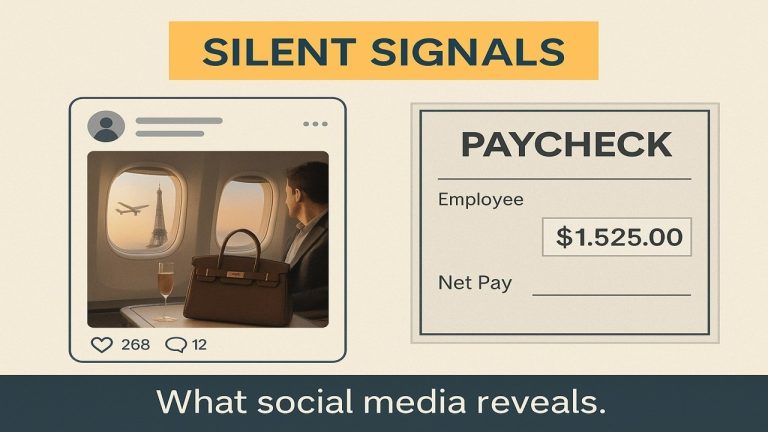

- Silent Signals – Social Media Clues: Monitor social media and online presence for postings of lavish purchases or activities that contradict an employee’s reported income.

- The Family Factor – Spouses and Dependants: Include spouses and dependants in audits, as unexplained wealth or assets in their names can signal that an employee’s illicit gains are being parked with family.

- Ghost Assets – Third-Party Ownership: Be alert to assets concealed through third parties or shell entities (friends, extended family, trusts) to hide an employee’s beneficial ownership.

- Clubs, Cars, and Country Estates – Memberships and Luxury Assets: Check for extravagant club memberships, luxury vehicles, or vacation properties that are disproportionate to known income – conspicuous luxuries often accompany illicit enrichment.

- The Rental Ruse – Lavish Living Without Assets: Investigate cases where employees live in luxury accommodation or enjoy high-end cars via leases or “rental” arrangements, which may mask true spending.

- Digital Breadcrumbs – Online Activity: Leverage data analytics and open-source intelligence (OSINT) to track online footprints (social media, property records, emails) that corroborate or expose inconsistencies in an employee’s lifestyle.

Two case studies demonstrate how companies have utilised lifestyle audits to uncover internal fraud and corruption. In each case, we outline the issues discovered, the audit methods used, and the consequences for the individuals and organisations involved. The paper concludes with a summary of key insights and emphasises the importance of a comprehensive, ethical approach to lifestyle audits as part of a corporate risk management strategy.

Introduction

Corporate fraud and corruption often leave traces in the lifestyles of those involved. A mid-level employee driving a supercar or acquiring multiple properties on a modest salary is a glaring warning sign that something may be amiss. In fact, the Association of Certified Fraud Examiners (ACFE) reports that an employee “living beyond their means” is the single most common red flag of occupational fraud. Lifestyle audits capitalize on this insight by systematically comparing an individual’s known income to their assets, expenditures, and living standards. If a significant mismatch is found, it raises suspicions of undeclared income – potentially stemming from embezzlement, bribery, kickbacks or other illicit activity.

Originally more common in government investigations, lifestyle audits are now increasingly employed in the corporate sector as well. Businesses of all sizes use them as a proactive risk management tool to detect internal fraud, deter unethical behaviour, and reinforce a culture of transparency. A lifestyle audit typically gathers data from many sources: bank and credit records, property and vehicle registries, company expense reports, and even open-source intelligence like social media posts. By triangulating this information, auditors determine whether an employee’s apparent wealth is supported by legitimate income. Importantly, lifestyle audits are an early warning system – they highlight anomalies that warrant deeper investigation, rather than directly accusing someone of wrongdoing.

However, standard audits can miss subtle clues. It’s not enough to glance at salary vs. bank balance; illicit enrichment can be obscured through creative means. Some employees finance lavish lifestyles through perks or third parties that don’t show up in payroll records. Others may display sudden changes in spending patterns outside the office that slip under the radar. The following sections delve into the often-overlooked facets of lifestyle audits – areas where inattention could allow fraud to fester unchecked. Each section corresponds to a critical theme (drawn from real-world scenarios) that executives should consider when overseeing or commissioning lifestyle audits in their organisations. By shining a light on these blind spots, companies can strengthen their defences against financial misconduct while ensuring audits remain fair and effective.

Beyond Bank Statements: Uncovering Red Flags in Employee Asset Ownership

A common mistake in lifestyle audits is focusing narrowly on bank statements and pay slips. In reality, fraudulent gains are frequently funnelled into assets – real estate, cars, investments, and luxury goods – that may not be obvious in an employee’s basic financial records. A thorough lifestyle audit goes beyond bank statements, examining external records of asset ownership for signs of unexplained wealth. For example, property title searches or vehicle registration checks might reveal that a junior manager on a modest income has acquired multiple houses or high-end cars in a short time. Such acquisitions, if unsupported by legitimate income or loans, are classic red flags.

Indicators can include sudden purchases of high-value assets (homes, condos, land) or collectable items like fine art and jewellery. Even indirect asset traces should be probed – for instance, large mortgage payments or ownership of investment accounts that don’t align with known income. A lifestyle audit recently uncovered a case where an employee who appeared financially average was found to own an upscale apartment and a sports car outright, raising immediate concerns of unreported income or embezzlement. By broadening the audit scope to include public records and asset registries, companies can spot these discrepancies early. The key is to verify whether each significant asset in an employee’s life has a plausible funding source. An unexplained asset is often the first clue in unravelling a hidden flow of funds.

Invisible Perks: How Unmonitored Benefits Can Skew Lifestyle Audit Results

Not all lifestyle inflation comes through official salary or obvious cash flow – some of it hides in invisible perks. These are benefits and fringe advantages that, if unmonitored, can mask or facilitate misconduct. For example, an employee might abuse a company expense account or corporate credit card to dine at expensive restaurants, effectively enjoying a lavish lifestyle on the company’s dime without any direct salary increase. Alternatively, vendors and contractors might shower key employees with gifts, paid vacations, or “consulting fees” that are off the books. Such perks can significantly augment someone’s lifestyle while eluding a standard audit’s detection.

A lifestyle audit must therefore account for unmonitored benefits – the soft compensation and illicit favours that don’t show up in payslips. Audit teams should review expense reports, travel and entertainment budgets, and any corporate benefits usage for irregularities. An employee consistently claiming maximum allowances or using company resources for personal indulgences could be inflating their lifestyle invisibly. There is also the risk of quid-pro-quo arrangements: for instance, a procurement officer might receive an all-expenses-paid luxury trip from a supplier as a “thank you,” which doesn’t reflect in their income but certainly boosts their lifestyle. These hidden indulgences can skew audit findings by making a corrupt employee’s lifestyle seem congruent with their income (since someone else is footing the bill).

Investigators should cross-check whether lifestyle elements like luxury travel, club memberships, or high-end gadgets might have been obtained through company channels or third-party generosity. In one cautionary example, auditors discovered an executive enjoying free use of a vacation villa owned by a major vendor – a perk that explained his extravagant weekends despite limited personal funds. Gifts or rented luxuries can likewise mislead conclusions. As fraud experts note, people may receive expensive gifts or temporarily rent luxury items, which could make them appear “rich” without a corresponding income. Thus, auditors need to differentiate between genuine red flags and lifestyle boosts coming from legal perks or one-off windfalls. By bringing these invisible benefits to light, companies can ensure that a lifestyle audit gives a true picture of an employee’s financial reality, rather than a distorted image obscured by untracked benefits.

The Travel Trap: Analysing Business Trips That Don't Add Up

Business travel is a normal part of corporate life, but it can also be an avenue for fraud and indulgence if not carefully monitored. The “travel trap” refers to situations where an employee’s business trips don’t add up – itineraries that are unusually frequent, luxurious, or inconsistent with their role, potentially masking personal adventures or kickbacks. Lifestyle audits should scrutinise travel records and expense claims for patterns that might indicate abuse. For instance, if a sales manager claims an inordinate number of “conferences” in exotic locations or routinely flies first-class and stays at five-star hotels well beyond company policy, these are red flags. Such behaviour could mean the employee is using company funds to subsidise an upscale lifestyle on the road, or even that a vendor is bribing them by covering lavish travel upgrades.

Another aspect of the travel trap is travel frequency and unexplained destinations. If an employee is often “out of town” for vague meetings or trips that yield no clear business benefit, investigators should question what’s really happening on these travels. In some fraud cases, corrupt employees have concealed illicit meet-ups or offshore dealings under the guise of business travel. Even when trips are legitimate, unusually high travel expenses relative to peers could signal that the employee is gaining extra comforts (limousines, expensive meals, extended stays) potentially paid through illicit gains. According to forensic auditing insights, frequent or luxury travel is indeed one of the subtle warning signs of possible fraud.

To analyse this, lifestyle auditors compare the employee’s travel expense patterns with company policy and industry norms. They also verify if trip outcomes (like new clients or sales) justify the costs. Any discrepancies – like a $10,000 “business development” trip that produced no evident business – warrant deeper investigation. In practice, one company’s audit revealed an executive who scheduled repetitive “business trips” to his favourite holiday resort, expensing personal leisure as corporate travel. The trap was sprung when auditors noticed the irregular destination and excessive cost, leading to disciplinary action. In summary, business trips should be proportionate and purposeful. When they’re not, a lifestyle audit can help connect the dots between dubious travel records and potential misconduct.

When Weekend Spending Tells a Story: Lifestyle Audits Outside Office Hours

Employees might keep a low profile from 9 to 5, but their weekend spending and off-hours activities can tell a very different story about their finances. A robust lifestyle audit doesn’t stop at examining official records; it also considers how individuals spend their personal time and money. Extravagant weekend habits – like hosting costly parties, frequenting high-end clubs, or indulging in expensive hobbies – can be strong indicators of undisclosed income streams. For example, if a mid-level employee is regularly seen driving to luxury beach resorts every other weekend or is known to throw lavish celebrations, these lifestyle clues may signal that their standard of living is higher than what their pay check should afford.

One illustrative scenario involved “Mr. Jones,” an employee whose Monday–Friday frugality gave way to extravagant weekends. An audit revealed that as of July, he had suddenly paid cash for a Maserati and began hosting champagne-filled parties, a drastic lifestyle uptick with no explainable income source. Such discrepancies outside office hours raised immediate questions: How could Mr. Jones afford this overnight leap in spending? In many cases, the answer is that they cannot afford it legally – the money is coming from fraud or kickbacks. Indeed, lifestyle auditors often find that it’s the Saturday splurges and holiday expenditures that expose a fraudster; during the workweek they might maintain appearances, but on weekends the illicit funds get spent.

Auditing off-hours behaviour can involve reviewing credit card statements for weekend transactions, looking at loyalty program usage (e.g. frequent high-end dining or luxury hotel stays), or even gathering tips from colleagues about conspicuous consumption. It’s important, of course, to distinguish personal choices from wrongdoing – some individuals might simply spend a high proportion of their income on leisure while saving little. However, consistent high-ticket weekend activities (country club fees, casino trips, expensive sports like yachting or golf at elite courses) by someone of modest means are usually a narrative worth probing. In sum, weekend spending can tell a story that complements the weekday audit. If that story features champagne tastes on a beer budget, it’s time for the company to dig deeper.

Silent Signals: Social Media as a Clue in Lifestyle Audits

In the digital age, employees often unwittingly broadcast their lifestyles online. These silent signals – Instagram photos, Facebook updates, LinkedIn bragging – can be a goldmine for investigators conducting a lifestyle audit. Social media provides a window into personal activities that an employee might not disclose at work. An individual who claims to live frugally on paper may simultaneously be posting pictures of new luxury vehicles, expensive vacations in Bali, or VIP tickets to events. Such posts can starkly contradict the financial profile they present to their employer. Auditors now routinely include an online search and social media review as part of lifestyle audits, a practice aligned with open-source intelligence gathering.

There have been real cases underscoring the value of these online clues. In one instance, junior government officials in an anti-corruption audit claimed minimal assets on official forms, but their Facebook and Instagram feeds told a different tale – photos with flashy cars, overseas holidays, and lavish parties were on full display. These silent signals tipped off investigators to glaring discrepancies between the officials’ declared means and their actual lifestyle. In a corporate setting, the same principle applies. An employee might not flaunt a new Rolex at the office, but they could very well show it off in a social media post.

Lifestyle audits leverage these clues by comparing social media content with known financial data. If someone’s online persona includes high-cost activities (e.g. frequent fine dining, luxury shopping hauls, or owning expensive gadgets) that don’t align with their salary, auditors treat it as a red flag for possible illicit income. Moreover, metadata from posts can offer additional intel – geolocation tags on photos, for example, might reveal frequent travel abroad or ownership of a second home not previously identified. A word of caution: social media can sometimes distort reality (people may exaggerate or live on credit), so findings must be verified. Nonetheless, these silent signals are an invaluable supplement to traditional audit data. They often provide the first hint of a lifestyle that “doesn’t add up,” enabling auditors to target their investigations more effectively.

The Family Factor: Why Spouses and Dependants Shouldn’t Be Ignored

When conducting lifestyle audits, looking only at the individual employee in isolation can be a critical oversight. The family factor recognizes that spouses, partners, and dependent children are often entwined in an employee’s financial story – for better or for worse. Corrupt employees may try to hide illicit assets by placing them under a spouse’s name or funding a lavish lifestyle for their family members instead of themselves. Conversely, an affluent spouse or family inheritance could legitimately explain what looks like unexplained wealth, meaning an audit must carefully discern such cases. In short, spouses and dependants shouldn’t be ignored; they can either be conduits for misconduct or sources of clarification.

Forward-thinking companies have started to formally include close family in their audit scope. A notable example is KPMG’s post-scandal integrity drive in South Africa. In 2019, KPMG began evaluating not just the financial lifestyle of its partners and staff, but also those of their immediate families. The policy was applied indiscriminately – “Every single partner, their spouses and dependent children go through this [audit], even I and my family,” reported KPMG’s CEO of the initiative. This comprehensive approach stemmed from hard lessons learned: ignoring an employee’s family wealth can leave a blind spot where corruption breeds. If an employee’s husband, wife or child suddenly acquires expensive assets or starts a luxury business, it might be the employee’s undeclared income funding it behind the scenes.

Auditors therefore gather information on family financial links: joint bank accounts, properties co-owned by spouses, businesses registered under a family member’s name, etc. Public databases and corporate records are checked to see if, say, a spouse is listed as a director of a supplier company (a sign of a possible conflict of interest or kickback channel). In one fraud case, a manager channelled bribe money into a company officially owned by his brother; only by examining family connections was the scheme uncovered. The family factor also extends to lifestyle clues: an employee might appear moderate, but if their children are attending ultra-expensive schools or their spouse drives a new luxury SUV with no obvious income of their own, these merit scrutiny. Of course, auditors must respect privacy and legal boundaries – typically focusing on publicly available information or that which the employee is obliged to declare. The goal is not to intrude unnecessarily, but to ensure that an employee isn’t using relatives as “safe deposit boxes” for ill-gotten gains. In summary, including spouses and dependants in the picture provides a 360-degree view of an employee’s economic reality, closing a major gap in lifestyle auditing.

Ghost Assets: Identifying Hidden Wealth Through Third-Party Ownership

Fraudsters often get crafty in concealing wealth, resorting to “ghost assets” – assets that they control and enjoy, but which are legally owned by someone else. By putting homes, cars or investments under the names of trusted third parties (friends, extended family, shell companies, or trusts), an employee can live rich while appearing clean on paper. Lifestyle audits that overlook these arrangements may falsely conclude everything is in order. That’s why identifying hidden wealth through third-party ownership is crucial. Auditors must be alert to signs that an employee has beneficial use of assets not officially in their name. For example, does the person live in a house registered to a cousin? Drive a car leased under a friend’s company? Such clues suggest ghost assets at play.

Investigators use a variety of techniques to flush out these hidden holdings. Public records and registries can link employees to entities or addresses indirectly – perhaps an employee’s listed home address is a property owned by a family trust. In some cases, forensic accountants examine whether an employee is making large “rent” or “loan” payments to an individual, which could actually be a cover for purchasing an asset via that person. The ACFE notes several common tactics: corrupt individuals may transfer assets to closely connected persons or trusts to evade detection, or funnel illicit funds into paying down mortgages and loans in others’ names. All of this creates a smokescreen around their true net worth.

One dramatic example involved an official who claimed to own only a modest apartment, but investigators found through open-source searches that a luxury mansion was built on his elderly father’s property – the official’s unexplained wealth was financing it, effectively making it his own in all but name. In another case, a lifestyle audit in Eastern Europe famously used Google Earth imagery to spot a palatial home on land belonging to an official’s associate, a property the official regularly used but hadn’t declared. These ghost assets were exposed by looking beyond the obvious. To tackle this, auditors compile data from company records, land registries, vehicle databases, corporate directorship filings, and even utility records that might tie an individual to an asset unofficially. By piecing together these threads, hidden wealth can be brought to light. The message is clear: whatever clever means are used to stash illicit wealth, a diligent lifestyle audit that follows the money and the associations can often turn these “ghosts” into tangible evidence.

Clubs, Cars, and Country Estates: What Memberships Can Reveal About Misconduct

Lifestyle audits aren’t only about bank balances and houses – they also delve into the trappings of status. Exclusive club memberships, luxury automobiles, and country estates (or other high-maintenance properties like yachts and holiday villas) can speak volumes about a person’s financial conduct. These items often come with hefty price tags not just for purchase but for ongoing fees and upkeep, making them reliable indicators of wealth. When an employee maintains such luxuries without a commensurate legitimate income, it raises the question: where is the money coming from?

For instance, membership in a prestigious golf club or private country club typically entails initiation fees and annual dues running into the thousands of pounds. If a mid-level employee is on the roster of one of these clubs, paying, say, £10,000 a year in fees, auditors will want to see a clear lawful income or savings source covering it. The same goes for high-end cars – not only the purchase or lease cost but insurance and maintenance. A new luxury car model spotted in the office parking lot being driven by someone who earns a modest wage is a red flag that warrants discreet inquiry. Similarly, country estates or holiday homes signal substantial wealth tied up in property. If an employee is spending weekends at a second home in the countryside or owns investment real estate beyond what their salary could finance, a lifestyle audit should probe how those assets were acquired. These kinds of possessions are often favoured ways for individuals who benefit from graft to spend or park their illicit gains, precisely because they confer status and enjoyment while seeming less liquid than cash.

One real-world auditing firm recounts how a routine vetting caught a procurement officer who quietly held a stake in a luxury game lodge resort – far beyond his pay grade – which turned out to be partially paid for by suppliers seeking favouritism. In another scenario, an accounting employee with a passion for cars had a small fleet of high-end vehicles registered under an LLC (Limited Company) he controlled; an asset check revealed this anomaly and eventually uncovered that he had been skimming funds for years to support his auto collection. These examples show how club memberships and luxury assets can reveal misconduct: they either directly evidence unexplained spending or lead investigators to hidden networks of transactions.

During an audit, compiling a list of any elite memberships (country clubs, yacht clubs, private gyms, societies) and comparing it against the individual’s financial profile is a useful step. Likewise, checking vehicle ownership records for luxury models and reviewing any associated loans or lease payments can provide insights. Many who engage in fraud or corruption eventually indulge in “toys” and exclusive affiliations – it’s human nature to want to enjoy ill-gotten wealth. As forensic experts note, lavish spending on “conspicuous items such as cars, homes and investments” is a common way for criminals to use illicit funds. Therefore, tracking those very items is essential. In summary, clubs, cars, and country estates are more than status symbols in a lifestyle audit; they are potential evidence, each with a story to tell about an employee’s integrity (or lack thereof).

The Rental Ruse: Investigating Lavish Living with No Traceable Income

What if an employee appears to live large but technically owns very little? This scenario is the “rental ruse,” where an individual enjoys a lavish lifestyle through rentals, leases, or borrowing, thereby keeping assets off their name. On the surface, they have no mansions or sports cars registered to them – which might initially appease a basic audit – yet they could be spending exorbitant sums on rent or lease payments that far exceed what their salary should cover. Investigating this requires auditors to look at outgoing expenses and lifestyle evidence, not just asset registers.

For example, consider an employee who doesn’t own a home but resides in a pricey rented penthouse in the city centre. The monthly rent could be several times their take-home pay, clearly unsustainable without outside funds. Similarly, rather than buying a luxury car, a person might lease one or continuously rent high-end vehicles. These costs may not show up as owned assets, but they are a financial commitment indicative of wealth. Lifestyle audits must therefore examine living arrangements and recurring expenditures. Clues can come from credit reports (which may list large lease obligations), reimbursement records (if they attempt to push some costs through expense claims), or simple observation – e.g. noting the neighbourhood an employee lives in and typical rents there. If someone in a junior role lists a swanky address, it begs the question of how they afford it.

Another layer to the rental ruse is the use of proxies to pay. An employee might claim, “Oh, I’m just renting,” but a dig into bank statements (or lack thereof) might show they aren’t the one paying the rent at all. Perhaps a shell company or a “friend” pays the landlord – a friend who could be a beneficiary of the employee’s corrupt dealings. In one fraud examination, investigators found that a manager’s luxurious apartment rent was being paid by a contractor who had won several lucrative bids from the manager’s department. This clear conflict of interest was only uncovered by matching the rental payments to an external source.

It’s also possible for individuals to rent luxury items short-term – for instance, chartering yachts for holidays or renting expensive jewellery and art – to project an image of wealth without long-term ownership. While these might be harder to catch, even sporadic bursts of high spending (documented by credit card bills or travel itineraries) can tip off auditors. Analysts caution that not every apparent extravagance means guilt; some people legitimately choose to allocate their income on lifestyle rather than savings. However, when there’s lavish living with no traceable income, that disparity is exactly what lifestyle audits are designed to flag. By following the money spent – not just the money earned – auditors can expose ruses where conventional asset checks alone would fall short.

Digital Breadcrumbs: Using Online Activity to Support Lifestyle Audit Findings

Modern lifestyle audits increasingly benefit from the trail of digital breadcrumbs that individuals leave behind. Beyond social media (covered earlier), there are many other online activities and data sources that can support audit findings or raise new suspicions. Email records, for instance, might show conversations about expensive purchases or travel plans. Company IT logs could reveal an employee frequently visiting luxury shopping websites or real estate portals during work hours, hinting at interests beyond their apparent means. While such browsing alone isn’t proof, it complements the overall picture. Moreover, loyalty accounts, online banking, and e-commerce receipts accessible on work devices (where policy allows monitoring) might inadvertently expose personal expenditures.

One powerful aspect of digital tracing is the use of data analytics and cross-database checks. Advanced auditing tools can cross-reference employee information with vast external data sets to spot anomalies automatically. For example, an analytics system might flag if an employee’s ID or address pops up in property purchase records or luxury car registrations that were not disclosed. It can also correlate patterns – say, detecting a sudden spike in online foreign money transfers, or identifying that an employee’s email is linked to a PayPal account showing large transactions inconsistent with their salary. These digital breadcrumbs provide leads that a human investigator might otherwise miss. As noted by forensic specialists, leveraging big data can reveal patterns like “sudden increases in asset ownership, unexplained overseas transactions, or social media posts flaunting expensive purchases,” all of which can be flagged for review.

Open-source intelligence (OSINT) extends to creative digital sleuthing. Investigators have used tools like Google Earth and public registries to great effect. In one notable anecdote, auditors examining a public official’s finances turned to Google Earth satellite images and spotted a lavish mansion erected on a property nominally belonging to the official’s relative. The official had never declared this asset, but the digital evidence was plain to see and ultimately supported a case of unexplained wealth. Other online breadcrumbs include metadata in digital photos (which can show GPS coordinates of frequent travel spots or presence at luxury venues), or even analysis of an individual’s connections on professional networks that might reveal undisclosed business interests.

It’s important for companies to use these techniques ethically and in line with privacy laws – typically focusing on publicly available data or company-owned data streams. Done correctly, integrating digital forensics into lifestyle audits greatly amplifies their effectiveness. Online activity can corroborate findings (for example, confirming that a suspect purchase indeed happened) or it can alert auditors to discrepancies (like a lifestyle that looks far swankier online than on official forms). In both ways, digital breadcrumbs ensure that no stone is left unturned. They bring to the surface the hidden pieces of the puzzle, allowing the organisation to see the full picture of an employee’s lifestyle and make informed decisions about any necessary investigations or actions.

Case Studies

this section presents two real-world case studies. In each case, a company conducted a lifestyle audit that led to the discovery of serious misconduct. We will examine the red flags noticed, the methods the auditors employed to investigate, and the consequences that followed.

Case Study 1: Financial Controller’s Lavish Lifestyle Exposes Embezzlement

A mid-sized manufacturing company had a long-serving financial controller who was regarded as trustworthy. On paper, his salary was moderate and his bank records showed nothing unusual at first glance. However, whispers around the office hinted that he lived far more opulently than one would expect – multiple properties, luxury cars, and expensive tastes. It wasn’t until a new CFO took an interest that a formal lifestyle audit was initiated. The audit compared the controller’s known income and declared assets to external data and observations: indeed, he owned several upscale homes and high-end vehicles far beyond his pay grade. This glaring disparity was the smoking gun that triggered a full forensic investigation.

The investigators dug into internal financial records and soon uncovered the scheme: over a period of years, the controller had quietly siphoned off company funds and falsified entries to cover his tracks. His lavish lifestyle – which had included luxury real estate investments and a garage of sports cars – had been financed directly by the company’s money. The belated lifestyle audit had finally brought these anomalies to light, after standard audits failed to catch the embezzlement earlier. According to an account of the case, once confronted with the evidence, the controller admitted to embezzling funds for nearly a decade. The impact on the company was severe: over $2 million had been stolen to fund his extravagances, directly affecting the firm’s profits and financial stability.

The consequences were swift and stern. The financial controller was terminated immediately and subsequently prosecuted on multiple counts of fraud. Law enforcement seized several of his properties and cars, and the company pursued civil action to recover what assets it could. This case was a wake-up call for the organisation. In the aftermath, the company’s executives strengthened their internal controls and made lifestyle audits a routine part of oversight for key finance personnel. The audit methods used in this case included cross-referencing property records (revealing titles to homes in the controller’s name), reviewing luxury car registrations, and analysing his spending patterns on credit cards. It was a comprehensive approach that, had it been employed sooner, might have detected the warning signs years earlier. As one executive noted ruefully, “the signs were hiding in plain sight – a man of modest means suddenly living like a millionaire.” This case underscores why companies must pay attention to lifestyle red flags and not dismiss them as personal matters. Anomalies in an employee’s lifestyle, once verified, provided the hard evidence needed to uncover and stop a long-running fraud, thereby preventing further losses and restoring integrity within the finance department.

Case Study 2: Procurement Manager Caught in a Kickback Scheme

In a second example, a large logistics company grew suspicious when a procurement manager consistently awarded lucrative contracts to a particular small vendor. The manager’s lifestyle also raised eyebrows: despite a relatively modest salary, she was seen driving a new luxury SUV and had recently purchased a holiday cottage in an expensive coastal area. Sensing a potential conflict of interest, the company commissioned a targeted lifestyle audit focused on this manager. The audit revealed that her personal asset acquisitions were indeed far beyond what her income could support – a classic sign of possible kickbacks or bribes. Investigators discovered luxury vehicles and properties registered in her name that were inexplicably high-value given her role.

Using this information as probable cause, the company’s forensic audit team dove deeper. They examined the procurement contracts and traced financial flows. It emerged that the favoured vendor had been inflating contract prices and covertly funnelling a percentage of the overpayments to the manager as kickbacks. The lifestyle audit’s findings – the expensive car, the new property – were the tip-offs that money was flowing under the table. Once the kickback scheme was confirmed, the company acted decisively. The procurement manager was suspended and ultimately fired, and law enforcement was brought in due to the corruption involved. The vendor in question was blacklisted and sued for damages.

The audit methods used combined traditional financial analysis with the lifestyle review. Bank records alone might not have immediately shown the bribery, because the illicit payments were disguised (some were routed through the manager’s spouse’s account, others labelled as “consulting fees”). But the lifestyle audit provided context and leads – for instance, it identified a series of large cash deposits coinciding with the timing of contract awards, which on further investigation were linked to the vendor’s payouts. It also uncovered that the manager’s luxury SUV was bought outright just weeks after one big contract signing, a suspicious timing that she could not convincingly explain. By connecting these dots, auditors turned disparate clues into a coherent case of misconduct.

The consequences were significant not only for the individuals but for the company’s culture. The organisation saved an estimated several million dollars by terminating the fraudulent contracts and renegotiating honest deals. It also recovered some assets; the manager’s seaside cottage was seized by authorities as it was proven to be purchased with illicit funds. Importantly, this case study had a ripple effect within the company – it prompted a thorough review of the procurement department. Additional lifestyle audits were conducted on other staff in sensitive positions, and stricter controls (such as mandatory vendor rotation and dual approvals on contracts) were implemented to deter future collusion. This case demonstrates the power of lifestyle audits in exposing corruption: the manager’s sudden wealth was not magic or luck, it was the product of a hidden kickback arrangement. By paying attention to those outward signs and rigorously investigating them, the company was able to root out the misconduct early, send a message to employees and vendors alike, and avoid further financial harm.

Conclusion

Lifestyle audits have proven to be an effective but underutilised weapon in the corporate fraud prevention arsenal. As shown throughout this paper, focusing on the often-overlooked aspects – from asset ownership and family finances to social media posts and digital footprints – can mean the difference between catching a rogue employee early and letting losses mount undetected. Executives reading this should recognise that while traditional audits and controls are necessary, they may not always flag an employee who is “living beyond their means.” It takes a holistic lifestyle audit, looking at the full picture of an individual’s expenditures and assets, to uncover those invisible threats to the organisation’s integrity.

Crucially, lifestyle audits should be conducted ethically and thoughtfully. They are a means to identify red flags, not an automatic accusation of guilt. The goal is to prompt further investigation when something doesn’t add up, as well as to deter employees from contemplating fraud in the first place. When staff know that conspicuous discrepancies between income and lifestyle might be noticed, it reinforces a culture of accountability and honesty. Companies that have embraced periodic lifestyle audits – especially for high-risk roles in finance, procurement, or executive management – report stronger internal controls and have often nipped schemes in the bud before they escalated. The case studies we discussed highlight both the methods and benefits: in each instance, lifestyle audits led to uncovering serious fraud and ultimately saved the organisations from greater harm (financial and reputational).

For implementation, executives should consider establishing clear policies around lifestyle audits, possibly as part of a wider fraud risk management program. This includes defining when an audit can be triggered (e.g. on suspicion of wrongdoing or as random checks), ensuring employee privacy is respected (audits should be done confidentially and fairly), and using independent experts when necessary to avoid bias. Technological tools – data analytics and OSINT techniques – can significantly enhance the efficiency of such audits, but human judgment remains key in interpreting results and distinguishing legitimate wealth from illicit enrichment or vice versa.

In conclusion, a lifestyle audit shines a spotlight on the human factor of fraud. It asks a simple question: Does this lifestyle make sense given what we know? When the answer is no, it urges us to investigate why. By looking beyond bank statements to all facets of an employee’s lifestyle, companies of all sizes can better protect themselves from internal fraud and corruption. The overlooked clues – a flashy car, a spouse’s sudden windfall, a string of “business trips” to tourist hotspots – will no longer be shrugged off as personal matters, but recognised as possible corporate risks. In this way, lifestyle audits, executed with care and rigor, become an invaluable component of good governance and ethical business practice, helping to safeguard company assets and uphold a culture of trust.