Cultural Red Flags Forensic Auditors Watch For

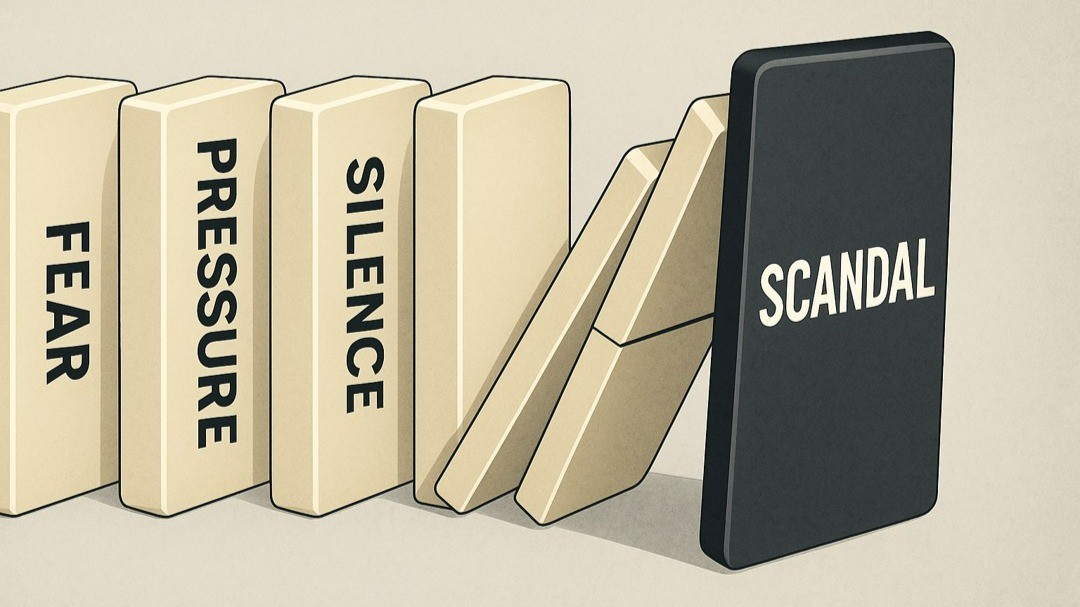

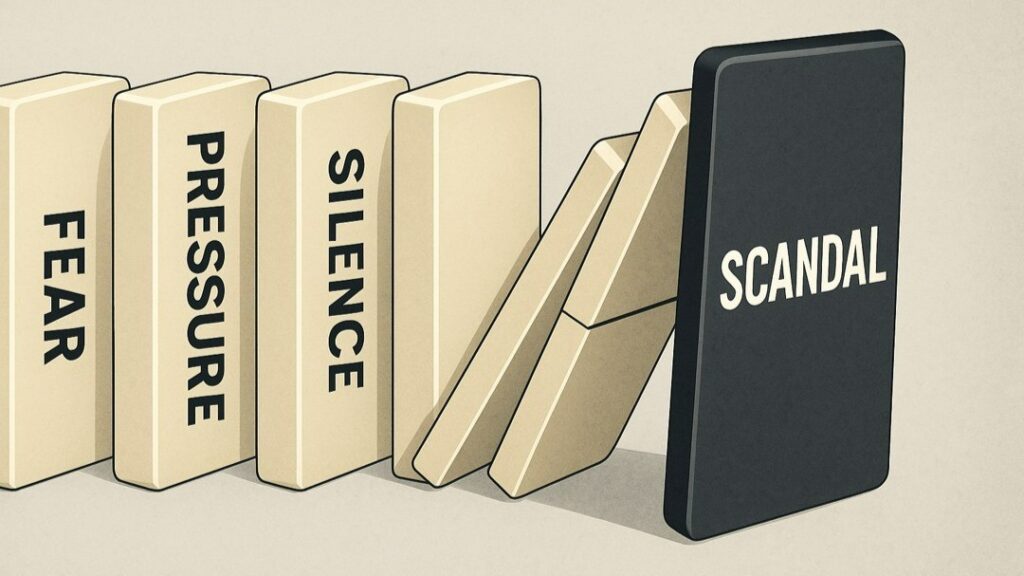

Forensic auditors know that fraud and misconduct rarely happen in isolation—they thrive in environments where fear, pressure, and silence take hold.

In our latest Duja Consulting paper, we explore the cultural red flags that signal ethical collapse across industries, and how executives can detect and address them before it’s too late.

From Wells Fargo’s toxic sales mantra to healthcare’s silence around poor care, the indicators are clear: culture makes or breaks ethics.

Executive Summary

Ethical breakdowns can occur in any industry – from banks and hospitals to tech firms, manufacturers, and government bodies – often with devastating financial and reputational consequences. In each case, a toxic organisational culture has been the common culprit. This report examines how forensic auditors and investigators identify cultural warning signs of impending ethical failures. We explore examples across industries, spotlight a case study of a major corporate ethics scandal, and detail the techniques used to surface cultural red flags. Finally, we provide actionable insights for executives to proactively monitor and strengthen their corporate culture, ensuring that “tone at the top” and throughout the organisation supports integrity rather than undermines it.

Introduction: Ethics Under Pressure Across Industries

When ethics fail, the fallout can be catastrophic. In finance, a leading bank’s employees – driven by unrealistic sales quotas – opened millions of fake customer accounts to meet targets. In manufacturing, a renowned automaker’s engineers installed illegal software to cheat emissions tests, reflecting a culture of solving problems “quickly rather than analysed” and pressuring staff into silence. Healthcare has seen hospitals where “the culture…focused on doing the system’s business – not that of the patients”, tolerating poor care to hit targets. Tech sector scandals, ranging from data privacy breaches to toxic workplaces and government corruption cases, further underscore that no sector is immune to ethical collapse. What unites these disparate failures is not industry specifics, but cultural indicators that something was deeply wrong within the organisation’s DNA.

For business leaders, the message is clear: ethical failures are often symptoms of cultural dysfunction. Forensic auditors – the investigators called in to examine fraud and misconduct – have learned to look beyond the surface of financial records. They dig into the character of the company itself, searching for warning signs in employee behaviour, management attitudes, and institutional norms. A company might have world-class products and solid revenues, but if it harbours a culture of corner-cutting, secrecy, or fear, it is a ticking time bomb. The following sections detail how these cultural red flags manifest across industries and how forensic experts detect them.

Ethical Breakdowns Across Industries: Common Cultural Red Flags

Ethical breakdowns have different faces in different industries, yet the cultural red flags are often strikingly similar. Below, we highlight key industries and the warning signs that forensic auditors and investigators pay attention to:

Finance (Banking & Investment):

In banking and finance, aggressive profit-driven cultures can breed misconduct. A prime example is Wells Fargo’s sales scandal, where an “Eight is Great” sales mantra and extreme pressure led employees to commit fraud just to keep their jobs. The cultural indicators were clear in hindsight: unrealistic targets, a fear-driven environment, and leadership’s tacit approval of “results at all costs.” High turnover in retail banking roles and ignored whistleblower warnings were early red flags. Forensic investigators reviewing such cases look for evidence of misaligned incentives and normalised rule-bending, such as emails celebrating hitting targets by any means or management overriding ethical objections. In another finance example, rogue trading incidents (from Barings Bank to more recent cases) often reveal cultures where controls were weak and star performers were exempt from scrutiny, creating an opportunity for fraud.

Healthcare:

Hospitals and pharmaceutical companies are bound by ethics to prioritise patient well-being – yet cultural failures have led to tragedy. In the UK’s Mid Staffordshire hospital scandal, a public inquiry concluded “it was the culture that did it” – a culture obsessed with government targets and cost-cutting while tolerating poor standards that risked patient care. Frontline staff felt unable to speak up, and warning signs (like spikes in mortality rates and patient complaints) were downplayed by management. Forensic auditors investigating healthcare organisations look for indicators of a dysfunctional culture: for instance, high complaint volumes, bullying or intimidation of staff, excessive secrecy in reporting outcomes, or a “shoot the messenger” approach to bad news. In pharmaceutical ethics failures such as the opioid crisis, one finds sales teams given free rein despite ethical concerns, and compliance staff sidelined – clear cultural red flags that profit had eclipsed ethics.

Technology:

The fast-paced tech industry often prides itself on a “move fast and break things” ethos – but when “breaking things” includes ethical boundaries, trouble follows. Scandals in tech have included data misuse, harassment, and toxic work climates. For example, Uber’s early growth was marred by a toxic bro culture that tolerated harassment and rule evasion, ultimately requiring a major culture cleanup. Key warning signs in tech firms include cult-like leadership that discourages dissent, HR departments that ignore complaints about superstar performers, and mottos that implicitly encourage bending rules (“growth at any cost,” for example). Forensic examiners in tech cases pay attention to employee exit patterns (e.g. waves of departures or similar complaints in exit interviews), internal chat logs revealing dismissive attitudes to regulation, or cliques forming “us vs. them” silos within the company. These cultural patterns can presage issues like intellectual property theft, privacy violations, or even fraud if left unchecked.

Technology:

In manufacturing, safety and integrity should be paramount – yet cultural failures have caused massive scandals. The Volkswagen “Dieselgate” case is instructive: internal investigations found a “culture of secrecy and cover-up” where solving engineering problems quietly was valued over transparency. Engineers who noticed wrongdoing were “pressured to keep quiet”, and an insular group manipulated emissions tests for years. Cultural red flags in such environments include a culture of fear or blind obedience (staff afraid to question decisions), favouritism (a tight inner circle controlling information), and a prideful belief that rules can be bent because “everyone’s doing it.” Similarly, in cases like the Boeing 737 MAX safety crisis, investigators highlighted management pressure for speed, employee reports of “undue pressure” on engineering teams, and dismissive attitudes toward safety feedback – all cultural indicators that profits had trumped safety ethics. Forensic auditors examining manufacturing firms often delve into regulatory interactions – e.g., a “habit of protracted discussions with regulators”-which can signal a company that repeatedly pushes the boundaries and then haggles when caught. They also look at whether quality control reports were ignored or doctored, which is easier in a culture where lower-level employees don’t feel safe escalating issues.

Government & Public Sector:

Government agencies and public institutions are not immune to cultural ethical failures. Corruption scandals (bribery, nepotism, expense abuses) frequently stem from a culture of impunity or political pressure. A notable pattern in public sector failures is an “ends justify the means” culture – for instance, a city government where officials normalised personal expense fiddles because “everyone else is doing it,” or a public health agency where meeting bureaucratic targets led staff to falsify data (as happened in a veterans’ healthcare scheduling scandal in the U.S.). Lack of accountability and oversight, nepotism, and silencing of conscientious employees are major red flags. Forensic investigators in government audits watch for unusually close relationships between officials and contractors, decisions consistently favouring a few “friendly” vendors, and systems of favouritism or retaliation that deter honest employees from speaking up. These cultural issues often presage illegal acts such as procurement fraud or cover-ups of malfeasance. In one example, a former city CFO embezzled funds for years under the nose of colleagues – a crime enabled by a culture of extreme trust in one individual and no separation of duties (a structural red flag).

While each industry has its unique operational context, the cultural warning signs of ethical failure are remarkably consistent. We turn now to a closer look at what specific red flags forensic auditors seek and how they investigate culture.

Cultural Warning Signs: What Forensic Auditors Look For

Forensic auditors are trained to detect not only hard evidence of fraud, but also the soft indicators that suggest a company’s culture is prone to ethical breaches. Experienced investigators often say that “fraud doesn’t happen in a vacuum – it happens in a permissive culture.” Below are some of the key cultural indicators and red flags that forensic auditors look for when assessing an organisation’s ethical health:

“Results at All Costs” Mentality:

An overriding management attitude that hitting targets and making numbers is the only priority, regardless of the means employed. This is a huge red flag. Auditors might spot this through internal slogans, emails, or meetings that emphasise performance without equal emphasis on integrity. If senior leaders obsess over short-term results and routinely override controls or bend rules to achieve them, the culture is primed for unethical conduct. As KPMG experts note, an overarching results-at-all-costs tone from the top is often the first cultural indicator of impending integrity problems.

Low Morale and High Turnover:

If employees are quitting frequently or morale is chronically low, it often signals deeper issues. A “revolving door of talent, especially in key positions,” points to a cultural problem. Forensic auditors will review HR data (turnover statistics, exit interview summaries) to gauge this. Departing employees frequently citing unethical practices, toxic management, or burnout is a smoking gun that the culture is unhealthy. Passive, disengaged staff who have “given up” raising concerns are equally worrying. High turnover paired with consistent grievances suggests an environment where employees either fear consequences of speaking up or refuse to be complicit, so they leave – either scenario bodes ill.

Normalised Policy Breaches:

Little rule-bending behaviours can become a habit, creating a slippery slope. Investigators watch for “minor but regular failures to follow company procedure or policies”, and a general disrespect for systems and controls. Examples might include expense policy violations tolerated for top performers, or managers who unofficially encourage skipping safety steps to save time. When small infractions go unchecked, they create an informal norm that rules can be ignored. Over time this can escalate to major fraud. Forensic auditors may uncover this through internal audits or interviews where employees say things like “Oh, that policy is more of a guideline; we all ignore it when needed.” Such attitudes, if widespread, indicate a cultural acceptance of cutting corners.

Silenced or Unquestioning Staff:

A particularly dangerous sign is when employees stop asking questions. “Passive and unquestioning staff who may be turning a blind eye to irregularities” are a red flag that people have either been cowed into silence or have become apathetic. Forensic interviews often reveal whether staff felt safe raising concerns. If auditors hear phrases like “I learned not to ask about that,” it points to a culture of fear or intimidation. Similarly, if whistleblower hotline records exist but show that issues were reported and then dropped with no action (or if few issues are reported despite other evidence of problems), it suggests employees assume nothing will change or fear retaliation. A history of retaliation against whistleblowers, if documented, is an especially glaring indicator of a toxic culture.

Excessive Secrecy and “Silos”:

Cultures that enable unethical behaviour often have pockets of secrecy. For instance, domineering managers who jealously guard certain relationships or processes create opacity. If one salesperson exclusively handles a certain vendor and resists oversight, or an executive insists only they can negotiate with a particular partner, auditors get suspicious – such silos can hide conflicts of interest or kickback schemes. Obsessive secrecy – need-to-know cultures where information is unusually restricted – may indicate leaders are concealing improper practices. Forensic auditors will probe areas of the business that operate with little transparency or have seen management overrides of controls. They also examine communication patterns: a lack of open communication, or important decisions made in backchannels, often correlates with ethical risks.

Favouritism and Nepotism:

A “culture of favouritism and nepotism” is another classic red flag. This can involve family members or friends in key roles without proper qualifications, or a “golden circle” of favourites who get promoted and shielded despite misconduct. When only a favoured few suppliers, agents, or employees get opportunities, forensic investigators suspect corruption or at least poor governance. They may conduct background checks and data analysis to uncover undisclosed relationships (e.g. an employee who secretly owns a vendor company – an undisclosed conflict of interest). Nepotism can also erode the culture by undermining merit and stifling employees who see unfairness, breeding cynicism that can lead to ethical lapses. Auditors often cross-reference vendor databases, payrolls, and corporate registries to spot if “independent” business partners are actually connected to insiders.

Pressure Cooker Environment:

Cultures perpetually in “crisis mode” or high-pressure can desensitise staff to ethical boundaries. Signs include employees working excessive hours, tension “you can cut with a knife” in the workplace, or managers habitually pushing staff to the brink. While hard-driving environments aren’t automatically unethical, forensic auditors know that unrealistic expectations and constant firefighting often lead to rule-breaking (employees find shortcuts to cope or justify unethical steps to meet goals). A red flag example: leadership that calls every project “mission critical” and implicitly or explicitly tells teams to “do whatever it takes”. Over time, this breeds burnout and corner-cutting. Auditors might gauge this through anonymous staff surveys or by noting patterns like chronic overtime, spikes in stress-related sick leave, or internal emails praising employees for violating policy to get things done – all cultural smoke indicating a potential fire.

Lack of Accountability and “Passing the Buck”:

In a healthy culture, people take responsibility; in a failing one, finger-pointing and denial reign. If an incident occurs and management’s first instinct is to deflect blame (onto rogue employees or “a few bad apples”) rather than ask “what about our culture allowed this?”, that itself is a warning sign. Forensic experts watch how organisations respond to small incidents: a culture that disciplines only junior staff for misconduct while higher-ups evade consequences is one where bigger ethical failures will fester. “Passing the buck” in leadership – frequent scapegoating or lack of ownership – signals that issues will be papered over. An investigator might review meeting minutes or emails after a breach to see if leadership showed accountability. Additionally, systemic lack of consequences for misbehaviour (e.g. top salespeople not punished for policy violations because they bring in revenue) tells auditors that ethics are subordinate to favourites or numbers, inviting larger violations.

In summary, forensic auditors consider a broad array of cultural indicators – from employee attitudes and management behaviours to how the organisation handles bad news. As one forensic accounting expert noted, financial misconduct rarely appears without cultural weaknesses enabling it. By identifying these red flags early, organisations can intervene before minor ethical lapses escalate into full-blown scandals.

How Forensic Auditors Uncover Cultural Red Flags

Detecting cultural problems requires going beyond traditional auditing techniques. Forensic auditors employ a variety of methods to “audit the culture” of an organisation – essentially performing a forensic culture investigation alongside the financial investigation. Key techniques include:

Deep Interviews and Confidential Surveys:

Unlike routine auditors, forensic investigators often conduct in-depth interviews with employees at all levels to get a candid picture of the workplace culture. Skilled forensic interviewers employ techniques to make interviewees feel at ease and to identify evasive or coached answers. They often ask open-ended questions about management style, pressure, and whether employees feel ethical concerns can be raised. Patterns in responses can be revealing – for example, if multiple staff independently describe a “fear of retaliation” or note that a particular manager “does things his own way,” these become leads to investigate further. Some forensic teams also deploy anonymous culture surveys (or review existing employee survey data) to quantify issues like trust in leadership, perceptions of ethics, and willingness to report problems. A sudden drop in positive responses over time or stark differences between departments can highlight problem areas. As the forensic specialist in one analysis recommended, regular culture assessments and anonymous surveys are invaluable tools to identify issues before they blow up.

Digital Forensics and Communication Analysis:

Modern forensic auditing leverages digital evidence to gauge culture. This means analysing emails, chat logs, and other communications for signs of unethical behavior or attitudes. Investigators may use keyword analytics to flag phrases indicative of misconduct (e.g. “off the books,” “nobody needs to know,” or aggressive language towards compliance staff). They also map communication networks – for instance, identifying if a small group communicates in isolation at odd hours (potentially colluding on a scheme). Tone analysis can even be applied: overly aggressive or fearful tones in internal communications might support other findings of a high-pressure or retaliatory culture. In one fraud investigation, auditors discovered emails where executives joked about “getting creative with the numbers” – a clear cultural signal that bending rules was tolerated. Forensic IT experts ensure that such digital evidence is preserved and analysed in a legally defensible way. They might also retrieve deleted messages or examine whether certain employees had encrypted or backchannel communications, which could indicate conscious efforts to hide activity from official systems.

Forensic Data Analytics on Transactions:

How does data analysis reveal culture? By looking for patterns that correlate with human behaviours influenced by culture. For example, an organisation with a culture of circumventing controls might show an unusual number of transactions just below approval thresholds (to avoid scrutiny) – indeed, an excessive number of purchases just under approval limits is a red flag. Forensic auditors will crunch accounting data to find such anomalies. They also analyse trends like frequently adjusting journal entries, especially if done late in reporting periods, which might indicate a culture of “make the books look good no matter what”. In a business with multiple units, if one region always beats targets remarkably (especially if performance exceeds market trends improbably) while also having many complaints or employee turnover, auditors would suspect a cultural issue enabling earnings manipulation or customer mistreatment in that pocket. By correlating performance data with HR data and even customer data (e.g. spikes in complaints), forensic analysts can pinpoint where cultural problems likely lurk. This data-driven approach helps target where to investigate further on the human side.

Review of Policies, Whistleblower Records, and Disciplinary Files:

Forensic auditors examine the organisation’s paper trail of ethics. They review code of conduct documents, training records, and whistleblower hotline logs. A robust policy that is ignored in practice (e.g. a whistleblower policy exists but employees say “you’d be punished if you used it”) indicates a culture gap between “walk and talk.” Investigators also scrutinise how past issues were handled: Are there records of internal investigations that were quietly closed or of high performers getting a slap on the wrist for infractions? Lack of formal action in the face of known problems is telling. On the flip side, a stack of unresolved complaints or repeat incidents could mean issues were simply patched over. Reporting system failures, such as unclear channels or no follow-up on issues, are often uncovered by this document review. In essence, forensic teams perform a “cultural compliance audit” – checking if the organisation practices the ethics it preaches, and where it doesn’t, understanding why.

Third-Party and Background Checks:

Culture issues sometimes manifest externally. Forensic investigators may run background checks on key personnel for past misconduct or check whether executives have connections that could pose ethics risks. They also investigate third-party relationships: a company consistently using a particular agent in a country known for bribery might reflect a culture willing to engage in corrupt practices. In proactive engagements, forensic auditors might be asked to perform “integrity due diligence” on a company’s partners or acquisition targets – here they look for any history of ethical lapses and evaluate the target’s culture for red flags (e.g. unusually high executive turnover or prior allegations of fraud). In one illustrative case, a company’s plan to acquire a foreign subsidiary was halted when a forensic background check revealed that the target’s country manager had a pattern of violating internal controls – indicating a local culture of rule-bending that would have posed major risks if inherited.

Use of Cultural Experts and Audit Frameworks:

Increasingly, audit and consulting firms have developed frameworks to audit culture explicitly. Forensic auditors might team up with organisational psychologists or use tools like culture surveys, focus groups, and even observation (sitting in on a team’s day-to-day operations) to get a qualitative sense of the workplace. The U.K. Financial Conduct Authority, for example, has encouraged identifying key cultural indicators for financial firms and monitoring them over time. Some organisations implement a “cultural barometer” – tracking metrics such as ethical training completion, survey scores, internal audit findings on conduct, etc., as an aggregate indicator of culture health. Forensic teams can use these to spot concerning trends. In practice, this means if the “cultural barometer” starts blinking red (say, a sharp rise in employee compliance hotline reports or a drop in perception of leadership honesty in surveys), investigators can zero in before a full-blown incident occurs. This approach transforms culture from a vague concept into something measurable and auditable.

Through these techniques, forensic auditors build a holistic picture of the company’s culture. They gather evidence not just of who committed an unethical act, but why the organisational environment allowed or even encouraged it. A telling observation from one forensic specialist: “When we investigate financial misconduct, we almost always find cultural weaknesses that enabled the problems to develop.” In the next section, we illustrate how cultural indicators played a role in a real-world corporate ethical failure.

Case Study: Wells Fargo – A Culture “Failure of Leadership”

One of the most cited corporate ethics failures of recent times is the Wells Fargo fake accounts scandal. It stands as a textbook case of how cultural indicators can foreshadow and explain a massive breakdown in ethics.

Background:

Wells Fargo, once lauded as one of America’s most respected banks, fell from grace when it was revealed in 2016 that employees had opened over 2 million deposit and credit accounts without customers’ knowledge or consent. This was done to meet aggressive sales targets in the bank’s “cross-selling” program. The scandal led to $3.7 billion in settlements, congressional hearings, and irreparable reputational damage. But years before regulators and the public learned of the fake accounts, the cultural red flags were present inside Wells Fargo.

Cultural Indicators Present:

Toxic Sales Culture:

The bank’s leadership had fostered what has been described as a “toxic sales culture.” Under the mantra “Eight is Great,” branch employees were pressured to sell at least eight products to each customer. These unrealistic sales goals, cascaded from the very top, set the stage for cheating. Employees who failed to hit quotas were threatened with demotion or dismissal. Such an environment normalised unethical shortcuts – in this case, creating fake accounts – as a means of survival. A healthy culture would have questioned whether those targets were reasonable or in customers’ interests; Wells Fargo’s did not, which was a glaring warning sign.

Ignored Whistleblowers and Lack of Accountability:

Internal reports and employee complaints about unethical practices began to surface as early as 2005 and continued for years. Yet senior management and the board largely ignored these warnings. Instead of fixing the culture, the bank fired many whistleblowers and lower-level employees involved in account falsification (over 5,000 employees were eventually terminated) while sparing top executives for far too long. This indicates a culture where speaking up was punished and leadership did not hold itself accountable. Indeed, investigators later found that executives had been aware of the problem but chose to look the other way. That pattern – problems “bubbling up” but being pushed back down – is a key cultural red flag that was present here.

Misaligned Incentives and Ethical Blind Spots:

Wells Fargo’s pay and bonus structures heavily rewarded volume of accounts and sales, regardless of quality or customer benefit. In effect, the bank “rewarded employees for hitting sales quotas, regardless of how those numbers were achieved”, and turned a blind eye to the methods. This misalignment sent a clear cultural message: revenue over ethics. Auditors often identify such incentive schemes as precursors to fraud – they create a pressure (and rationalisation) for employees to cut ethical corners. Additionally, there was a disconnect between Wells Fargo’s espoused values and daily reality. The bank’s stated vision emphasised “integrity and principled performance” and doing things “the right way”, yet the lived culture in retail branches was the opposite. This gap between “stated values and operational reality” is a classic cultural indicator of trouble – employees become cynical and may justify wrongdoing since leadership isn’t walking the talk.

Cultural Rationalisation and Groupthink:

Over time, many employees rationalised the unethical practices with excuses like “this is how we’ve always done it” or “everyone else is doing it” – examples of what experts call cultural rationalisations. These phrases actually appeared in later investigations as common refrains. Such normalisation of deviance is a cultural sign that wrongdoing has taken root as a norm. There was also an element of groupthink: branch teams often felt this was a team game to meet numbers, and those who objected were isolated as not team players. Forensic auditors consider these kinds of attitudes – “it’s not illegal, so it’s fine” or dismissing ethics for being prissy – as intangible yet critical evidence of a culture permissive of misconduct.

Detection and Aftermath:

How did forensic investigators and regulators finally crack through this culture? It took external intervention – a Los Angeles city investigation and an article – to trigger deeper probes. Once on the case, investigators subpoenaed internal documents and emails, finding references to “gaming” the sales system. They also saw the pattern of terminations and internal audit reports that pointed to longstanding issues. A review of HR records showed many employees had been raising red flags. Ultimately, the entire culture came under scrutiny. One U.S. Attorney summed it up: “This case illustrates a complete failure of leadership… Wells Fargo traded its hard-earned reputation for short-term profits”. The bank’s new leadership admitted the root cause was cultural and pledged to reform incentives, oversight, and values.

For business executives, the Wells Fargo case underscores that cultural indicators of ethical failure were visible long before the public scandal – extreme pressure, denial at the top, and misaligned rewards. A proactive forensic auditor or an internal culture audit might have caught these signals earlier. This is why paying attention to the warning signs we’ve outlined is so critical. In the final section, we turn to how executives can act on this knowledge to safeguard their organisations.

Actionable Insights for Executives: Proactively Managing Cultural Risk

A strong ethical culture is one of the best defenses against corporate misconduct. Conversely, cultural weaknesses can undo even the best compliance programs. Business executives and boards, therefore, must treat culture as a strategic priority – something to be actively monitored, measured, and managed.

Here are actionable steps and insights to help proactively address cultural risks before ethics fail:

1. Set the Tone at the Top – and the Middle:

Leadership behaviour is the cornerstone of culture. Executives should model the ethical standards they expect. This means not only talking about integrity but demonstrating it in decisions (for example, sacrificing a lucrative deal that conflicts with your values). “Tone at the top” is critical, but don’t neglect the “tone in the middle” – ensure middle managers also embody and enforce ethical practices. If an aggressive VP is contradicting the CEO’s ethics message by pushing teams unreasonably, that needs correction. Leaders must consistently reward ethical behaviour (praise or promote those who do the right thing, even if they miss a target) and sanction unethical behaviour regardless of results. Remember that employees take cues from what leadership actually tolerates or punishes more than what it says.

2. Align Incentives and Performance Metrics with Ethics:

Review what behaviours your compensation and evaluation systems actually encourage. If all goals are financial or quantitative, consider adding qualitative measures (customer satisfaction, compliance scores, team 360-feedback on leadership ethics). Misaligned incentives were at the heart of Wells Fargo’s issues – don’t let “what you pay people to do” conflict with “what you say is important”. Design incentive programs that do not reward unethical shortcuts; include checks such as clawback provisions for misconduct. Also, avoid setting unattainable targets that pressure staff into desperation. Ambition is good, blind pressure is not. As one study noted, employees will do what you measure and pay for “even when you’re saying something different” – so ensure your metrics and rewards reinforce the culture you want.

3. Implement Regular Cultural Audits and Indicators:

Just as you have financial audits, institute culture audits periodically. This could involve hiring independent specialists or using an internal audit with an expanded scope to assess cultural health. Identify a handful of key cultural indicators to monitor year-round – for example: employee turnover in key roles, number of ethics hotline reports (and their closure rate), employee survey results on questions like “management acts ethically” or “I feel safe reporting concerns,” and perhaps even external metrics like customer complaints or regulator inquiries. Boards can request a dashboard of these cultural indicators at least annually. If one or more indicators start trending poorly (e.g. rising turnover or dropping trust in leadership), treat it like a risk that warrants investigation. By tracking culture systematically, you are more likely to catch slippage early. Some organisations have even appointed “culture officers” or given the audit/risk committee explicit oversight of culture – moves that signal seriousness about the issue.

4. Foster Open Communication and Protect Whistleblowers:

An ethical culture is one where bad news travels fast upward, not where it’s buried. Establish multiple channels for employees to voice concerns – from anonymous hotlines to open-door policies and skip-level meetings. More importantly, respond to those concerns. If staff see action taken when issues are raised, it builds trust that speaking up is worthwhile. Absolutely enforce non-retaliation: make it clear that anyone found retaliating against a colleague for raising an integrity issue will face consequences. Publicise examples (without naming names, to preserve anonymity) of issues that were reported and addressed, so employees know the system works. By doing so, you counter the cultural red flag of reporting system failures or fear of speaking up. Consider periodic anonymous polls: “Do you feel comfortable reporting misconduct?” and track the percentage of “yes” improving. Executives should also encourage healthy dissent – explicitly invite employees to voice ethical concerns in meetings. A culture where the lone voice saying “this feels wrong” is respected can save your company from disaster.

5. Lead with Accountability and Transparency:

When mistakes or misconduct occur, model accountability. Rather than reflexively blaming “bad apples,” examine whether leadership decisions, pressure, or neglect enabled the issue. If a manager under you tolerated bad practices, acknowledge that and fix it. Transparency is also key: share with employees (and sometimes publicly) what went wrong and what is being done about it. This was a lesson from the Mid Staffordshire hospital case, where a duty of candour was emphasised after a culture of cover-ups – organisations must be honest about failings to learn from them. On a day-to-day level, cultivate a no-blame culture for reporting errors or near-misses – employees should feel the goal is to solve the problem, not shoot the messenger. At the same time, demonstrate that unethical actions have consequences consistently. If employees see that high performers are not exempt from rules, it reinforces a culture of fairness and justice.

6. Provide Training and Ethical Decision-Making Support:

Frequent, engaging ethics training helps keep awareness high. Go beyond legal compliance seminars – include scenario-based discussions relevant to your industry. Teach employees how to handle ethical dilemmas and encourage them to consider not just “Can we do this?” but “Should we do this?” Provide managers with training on how to embed ethics in their team management. Some firms have introduced ethical ambassadors or integrity champions within teams to promote dialogue about ethics. The goal is to make ethics an ongoing conversation, not a once-a-year checkbox. When people have the language and comfort to talk about ethical concerns, cultural red flags are more likely to be spotted and addressed internally. Additionally, integrate ethics into leadership development – tomorrow’s leaders should be those who understand how to balance performance with principles.

7. Engage Boards and External Eyes:

Finally, utilise your board of directors effectively in overseeing culture. Ensure the board (or a committee thereof) receives regular reporting on culture metrics and major conduct incidents. They should also occasionally meet directly with employees or conduct site visits to sense the culture beyond the executive suite. Some companies use external auditors or advisors to do an independent culture evaluation – a fresh pair of eyes might catch issues insiders overlook. Regulators and investors are increasingly interested in corporate culture as well, recognising its impact on long-term performance and risk. Being proactive here can not only prevent scandals but also provide reassurance to stakeholders that you take the “soft” risks as seriously as financial ones. As one expert noted, organisations that “proactively strengthen their cultures” gain advantages in performance and compliance – a strong culture is not just about avoiding negatives, it’s about enabling sustainable success.

Conclusion

Ethical failures in business are often depicted as sudden disasters or caused by a few bad individuals. In reality, they resemble slow-moving train wrecks, marked by numerous cultural warning signs that go unnoticed. Forensic auditors, with their investigative tools, have revealed what those signs look like: an obsession with results at any cost, employees afraid to voice concerns, rules gradually bending “just a little” more each day, and leadership that ignores inconvenient truths. These cultural indicators serve as early warning signs that ethics are about to break down.

The lesson for executives is to listen for those alarms and act decisively. No matter the industry – whether finance, healthcare, tech, manufacturing, or government – fostering a culture of integrity is your organisation’s best insurance. It is easier and much cheaper to address a cultural issue now than to rebuild after a moral failure. The case study of Wells Fargo and many others clearly shows that culture is either your primary line of defence or the unseen cause of your downfall.

Executives who promote a healthy culture will develop organisations where fraud and misconduct find it hard to take hold. By monitoring cultural indicators, empowering employees, aligning values with actions, and never losing sight of the human factors, leaders can ensure their companies don’t become the next warning story of “when ethics fail.” In business, as in life, what’s done in the dark will ultimately be exposed – so cultivate a culture that shines in the light. Your shareholders, employees, and the public will all benefit from it.