Follow the Money: Tracing Embezzlement Through Forensic Audit Trails | Duja Consulting

Embezzlement is rarely about a single “bad apple.” It often thrives in blind spots – weak controls, misplaced trust, and overlooked warning signs. Our latest paper examines how forensic audit trails reveal hidden embezzlement, the red flags executives should not overlook, and a South African case study that demonstrates the effectiveness of following the money.

Key insights include:

- The financial and reputational costs of insider fraud.

- Behavioural and financial red flags every executive should watch for.

- Tools and techniques forensic auditors use to unravel complex schemes.

- Practical steps executives can take to strengthen detection and prevention.

The message is clear: vigilance is not optional.

The audit trail is always there – the challenge is learning how to read it.

Introduction

Embezzlement is a threat that can quietly drain an organisation’s resources and erode stakeholder trust. Unlike external theft, embezzlement is carried out by insiders – employees or managers entrusted with company funds who misuse them for personal gain. This breach of trust can be devastating. Money lost to embezzlement not only impacts the bottom line, but also damages morale, reputation, and investor confidence.

This report first clarifies the concept of embezzlement and its impact on organisations, then discusses how forensic auditing is used to uncover such misconduct. It highlights common red flags and outlines the tools and methods auditors use to “follow the money.” A South African case study illustrates a successful forensic audit that exposed an embezzlement scheme, and the report concludes with practical recommendations to help executives strengthen detection and prevention mechanisms.

Understanding Embezzlement and Its Impact on Organisations

What is Embezzlement?

Embezzlement is a form of internal theft or fraud where someone misappropriates assets that were entrusted to them by the organisation. In other words, an employee, manager, or fiduciary abuses their position of trust to steal company funds or property. This could involve skimming cash, diverting payments to personal accounts, creating fake invoices, or other deceitful schemes. The critical element is that the perpetrator has legitimate access to the assets – they are an insider, not an outside thief. Because of this, embezzlement can be especially hard to detect; the person’s activities might initially appear routine or authorised.

Impact on Organisations:

Embezzlement can have severe financial and reputational consequences. Beyond the immediate loss of funds, companies face costs for investigations, legal proceedings, and restoring internal controls. Trust within the organisation may deteriorate, and external stakeholders could lose confidence. In extreme cases, high-value embezzlement has pushed companies into crisis or even bankruptcy. Studies suggest that internal theft and fraud contribute to a significant share of business failures. For instance, workplace theft (including embezzlement) is a factor in roughly 30% of business bankruptcies. The financial costs are striking: employee theft is estimated to cost businesses around $50 billion annually in the U.S. alone. Embezzlement schemes tend to be costly on a per-case basis as well – one analysis found that cases of embezzlement lead to average losses exceeding $350,000 each. In fact, the largest losses from fraud often come from trusted insiders rather than outside attackers. Apart from the monetary damage, organisations suffer reputational harm when such scandals come to light, potentially affecting investor trust and customer loyalty.

Key consequences of embezzlement include:

Direct Financial Losses:

Stolen funds, diverted revenues or misappropriated assets directly reduce the company’s financial resources. These losses can accumulate over time – often remaining hidden for months or years – and can significantly impact budgets and profitability.

Indirect Costs:

Organisations must invest in forensic investigations, legal fees, and remediation efforts after an embezzlement incident. Insurance premiums may rise, and the company could face fines or penalties if weak controls or compliance failures enabled the fraud.

Reputational Damage:

Publicised incidents of internal fraud undermine trust among investors, customers, and partners. A company’s brand can be tainted, leading to lost business opportunities and a lower market valuation. It can take years to rebuild credibility after a major embezzlement scandal.

Workplace Morale and Trust:

Discovering that a trusted employee has been stealing causes internal shockwaves. Other staff may feel betrayed or demoralised, and leadership’s credibility can come into question if oversight was lacking. This can hurt productivity and increase staff turnover.

Risk of Further Crime:

Money embezzled from a company might be used to fund other illicit activities, or the success of one scheme might embolden the perpetrator (or others) to attempt further fraud. A lack of swift action can make the organisation a repeated target.

In summary, embezzlement not only causes significant financial harm, but it also threatens the stability and integrity of an organisation. Corporate executives need to recognise that the danger is often from within: even long-time, trusted employees can perpetrate fraud given the right motive and opportunity. The next step is to consider how such misconduct can be uncovered and addressed – and this is where forensic auditing comes in.

The Role of Forensic Auditing in Identifying Financial Misconduct

Forensic auditing is a specialised branch of auditing focused on investigating suspicions of fraud and financial irregularities. Unlike a routine financial audit, which mainly checks compliance with accounting standards and verifies financial statements, a forensic audit digs deeply into specific areas of concern with the aim of finding concrete evidence of wrongdoing. Forensic auditors are often called “financial detectives” or “bloodhounds,” in contrast to traditional auditors as “watchdogs”. They are trained not just in accounting, but also in fraud examination techniques, legal procedures, and evidence handling.

When fraud is suspected, a forensic audit can be commissioned to “follow the money” and unravel what happened. These auditors will examine detailed records and audit trails rather than relying on high-level summaries or sample testing. The goal is to trace transactions and identify anomalies or patterns that indicate misconduct. Crucially, forensic auditors gather and preserve evidence in a manner that can withstand scrutiny in court or regulatory proceedings. They meticulously document each finding, maintain a clear chain of custody for documents, and may produce expert reports explaining how the fraud was executed and by whom.

Forensic audits have become essential because traditional audits often fail to catch insider fraud. Studies have shown that routine external financial audits detect only a small fraction of occupational fraud cases – less than 5%, according to one survey. By contrast, forensic audits fill this gap by employing deeper analysis and investigative rigour to unearth issues that conventional auditing might overlook. For example, an expense marked as a consulting fee might be traced and found to have actually been funnelled to a private company owned by an executive – a scheme a standard audit could miss. In the next section, we outline some key tools and techniques forensic auditors use to trace such audit trails.

Red Flags and Behavioural Indicators of Embezzlement

Even before a forensic audit is launched, certain warning signs (“red flags”) can hint at embezzlement. Executives should be alert to anomalies in financial records and changes in employee behaviour that could signal internal fraud.

Financial Red Flags

Unexplained Discrepancies:

Unaccounted shortages in cash or inventory, frequent “adjustment” entries in the books, or missing documents (like invoices or receipts) are classic warning signs of possible tampering.

Suspicious Transactions:

Watch for unusual patterns such as large round-number payments, repeated transactions just under approval limits, or payments to unknown vendors. Multiple complaints from vendors or customers about payments not received (when records show they were made) can indicate funds are being diverted.

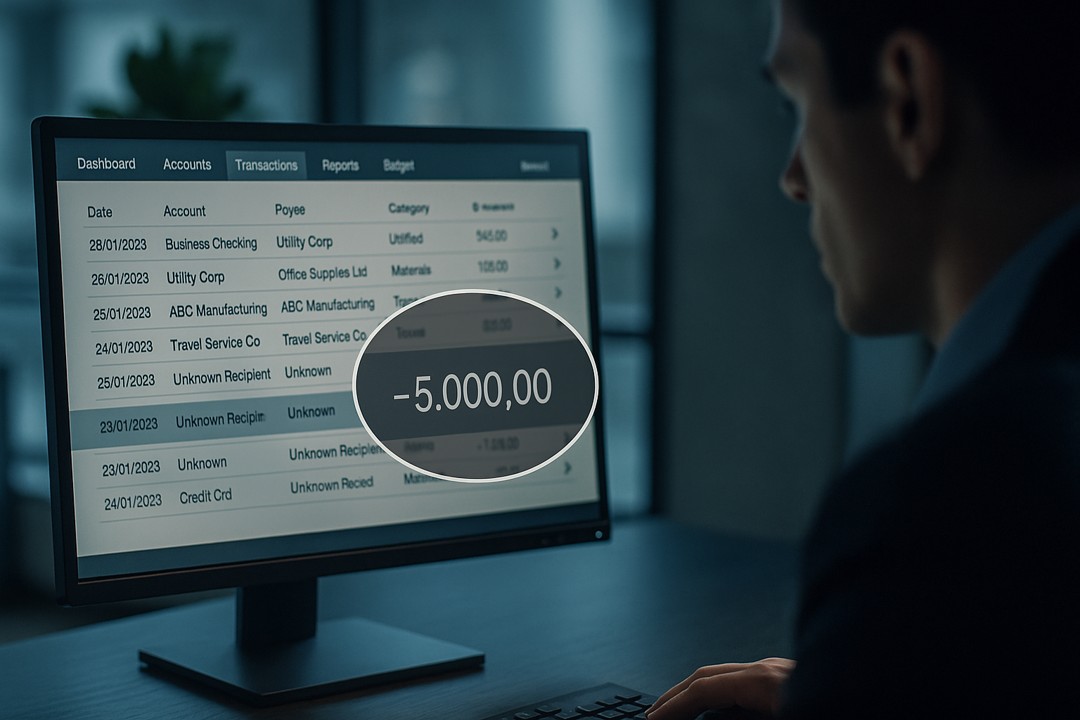

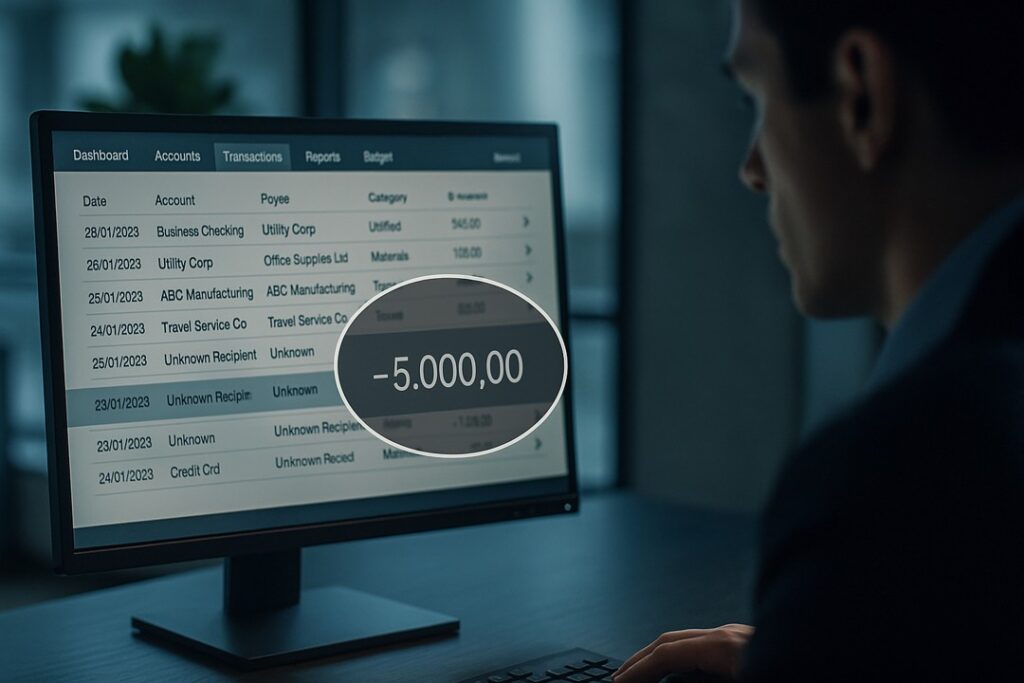

Irregular Account Activity:

Out-of-hours transactions (e.g. payments made late at night) or sudden spikes in expenses without clear reason may point to someone trying to hide illicit transfersduja.co.za. Additionally, any one employee performing all steps of a process – from requesting a payment to approving and recording it – could bypass normal checks and deserves scrutiny.

Behavioural Red Flags

Lifestyle Changes:

An employee living beyond their means – driving luxury cars or taking expensive holidays on a modest salary – can be a red flag, as can the opposite (unusual financial distress). Sudden wealth or financial hardship might motivate fraud and often correlates with embezzlement cases.

Refusal to Share Duties or Take Leave:

Fraud perpetrators often avoid stepping away from work. An employee who never takes vacation or refuses to delegate tasks may fear that someone else will discover irregularities in their files. This reluctance to rotate duties is a common indicator of hidden problems.

Defensive or Secretive Behaviour:

Be wary of individuals who resist audits, oversight, or even basic supervision. If a staff member becomes defensive when asked for financial data or is overly protective of records and systems, it could be because they have something to conceal.

Rule-Bending Attitude:

A pattern of circumventing policies or bypassing internal controls “to get things done” can set the stage for fraud. For instance, an employee who routinely ignores procurement rules or insists on using certain suppliers without explanation might be enabling a fraudulent arrangement.

No single red flag proves embezzlement, but if multiple signs converge, it should prompt further investigation. Early attention to these warning signs – and a willingness to “trust but verify” – can save an organisation from larger losses down the line.

Tools and Methods for Tracing Audit Trails to Uncover Fraud

In the fight against embezzlement, the phrase “follow the money” becomes a literal guiding principle. Forensic auditors deploy a range of tools and techniques to trace financial audit trails – the step-by-step records of transactions – and reveal where things went wrong.

Below are some of the key methods used to uncover financial fraud:

Data Analytics and Anomaly Detection:

Modern forensic auditing relies heavily on data analytics to comb through large volumes of transactions. Specialised software can analyse entire datasets (all invoices, all expense claims, etc.) and flag irregular patterns that a human might miss. For example, data analytics can identify round-dollar transactions, repetitive amounts, or transactions occurring at odd times that deviate from normal patterns. By using algorithms to detect anomalies, auditors can pinpoint suspicious entries for deeper investigation.

Continuous Monitoring Systems:

Rather than waiting for year-end audits, companies are increasingly employing continuous monitoring tools that provide real-time alerts for unusual financial activity. These systems act like a security camera on the accounts, flagging transactions that trigger certain risk criteria (e.g. a large payment to a new vendor or an employee expense claim far above the norm). Continuous monitoring enables earlier detection of embezzlement, as irregularities can be investigated immediately, potentially stopping fraud in progress.

Forensic Accounting Software:

Advanced forensic accounting platforms are the “Swiss Army knife” for investigators. These tools can automate data extraction from various sources (bank statements, accounting ledgers, emails) and then cross-compare records. They help trace the flow of funds through complex networks of accounts with speed and accuracy. Such software often includes modules for fraud pattern detection, making it easier to find evidence of known schemes (like ghost vendors or shell companies).

Benford’s Law Analysis:

A specialised technique, Benford’s Law analysis looks at the frequency distribution of digits in numerical data to spot fabricated numbers. In legitimate datasets (such as authentic expense reports), certain digits tend to appear in a predictable distribution. If an employee has falsified figures, the digit patterns might skew from the expected norms. Forensic auditors apply Benford’s Law to financial records to highlight where numbers may have been manipulated – a clever statistical way to detect if someone is essentially “making up” figures

Link Analysis and Data Visualisation:

Embezzlement schemes sometimes involve a web of relationships – multiple accomplices, fake companies, or layered transactions. Link analysis helps map these connections. Using visualisation tools, investigators can diagram links between employees, approvers, bank accounts, and entities to see how money flowed and who is connected to whom. This method is particularly useful for uncovering collusion (for instance, an employee conspiring with an outside supplier). Visual network mapping can reveal patterns that would be hard to spot in raw spreadsheets (such as one manager authorising payments to several related accounts).

Digital Forensics:

In today’s digital workplace, following the money trail isn’t limited to accounting ledgers. Embezzlers leave digital clues in emails, messaging apps, and computer files. Digital forensic techniques involve recovering and analysing electronic records to support the investigation. This can include retrieving deleted emails, checking server logs for unauthorised data exports, and examining the metadata of documents to determine when and by whom they were created or modified. Digital forensics also helps in understanding if a perpetrator tried to cover their tracks by deleting files or altering records – forensic IT experts can often retrieve those artefacts, even after an attempted cover-up.

By applying these tools, forensic auditors build a coherent picture of the fraud. They piece together the audit trail of suspicious transactions with supporting evidence (bank records, invoices, emails) to show who approved a transaction, who benefited, and how the fraud was concealed. This detailed reconstruction provides management and authorities with the evidence needed to take action and tighten controls moving forward.

Case Study: Forensic Audit Trail Exposes Embezzlement in South Africa

A prominent example of “follow the money” in action is the case of EOH, one of South Africa’s largest technology companies. In 2019, EOH became embroiled in a major fraud scandal, with whistle-blowers alleging that company insiders were bribing government officials to secure lucrative contracts. The claims prompted a key business partner to cut ties, and EOH’s share price collapsed as investors lost trust.

Facing an existential threat, EOH’s leadership commissioned an independent forensic audit by a law firm to uncover the full extent of the wrongdoing. For several months, forensic auditors pored over financial records, focusing on the suspicious public sector deals. They traced payments, examined emails, and followed every audit trail, with the support of the CEO and board to “find everything” without restraint.

The forensic investigation unearthed extensive corruption and embezzlement. One example was evidence of a mayor receiving kickbacks through a company linked to EOH – a clear indication of bribery in the tender process. The auditors identified specific fake suppliers and inflated invoices that had been used to siphon off funds. These findings provided hard proof of which executives and employees were involved and how they hid the illicit payments.

EOH acted swiftly on the forensic audit’s findings. The implicated employees and executives were removed from their positions, either fired or forced to resign. The company voluntarily reported the fraud to law enforcement and regulators, rather than trying to cover it up. It also initiated legal action to recover the stolen money and signalled its intention to press charges against the perpetrators.

To restore financial integrity, EOH restated its financial reports to account for the misappropriated funds and the costs of the investigation. While this meant acknowledging significant losses, it allowed the company to put the past behind it. With guidance from the forensic auditors, EOH’s management overhauled internal controls, strengthening board oversight, tightening payment approval processes, and implementing stricter governance checks to prevent future abuses.

These measures started to rebuild trust. By late 2020, EOH’s finances had stabilised; the company reduced its debt, and external auditors were able to give a clean audit opinion on its accounts, indicating that no further irregularities were present. EOH’s transparent approach also helped rehabilitate its reputation. The firm openly cooperated with a national anti-corruption inquiry (the Zondo Commission) and shared the forensic audit’s evidence to aid broader investigations. This openness distinguished EOH as a company committed to reform, which gradually won back goodwill from investors and the public.

In hindsight, the forensic audit was pivotal in saving EOH from potential collapse. It provided the executive team with a clear roadmap of what went wrong and who was responsible, enabling them to take decisive action to clean up the organisation. The EOH case demonstrates that even when an embezzlement scheme is deeply entrenched, a thorough follow-the-money investigation can expose the truth and provide a foundation for recovery. It is a powerful reminder to executives that confronting problems transparently and head-on – with the help of forensic audit trails – is key to overcoming major fraud crises.

Practical Recommendations for Executives on Detection and Prevention

Embezzlement can happen in any organisation, but there are concrete steps executives can take to reduce the risk and improve early detection.

Here are key recommendations for strengthening your company’s anti-fraud defences:

1. Establish Strong Internal Controls:

Ensure robust financial controls and checks are in place. Implement segregation of duties so that no single employee has end-to-end control over financial transactions (for example, the person who reconciles bank accounts should not also be the one signing cheques). Many frauds exploit gaps where one individual has too much unchecked power. Also enforce dual approvals for large payments and conduct regular reconciliations of accounts to catch discrepancies promptly. Additionally, schedule periodic internal audits and occasional surprise inspections of high-risk areas – these can detect anomalies that routine processes might miss.

2. Cultivate a Culture of Ethics and Transparency:

Tone at the top is critical. Leadership should demonstrate zero tolerance for fraud and openly encourage ethical behaviour. Foster a culture where employees feel comfortable raising concerns and know that integrity is valued over short-term results. Reward honesty and make it clear that whistleblowers will be protected, not punished. An ethical workplace culture can deter potential fraudsters – they know their colleagues are watching and will speak up.

3. Implement Whistleblower Channels:

Since tips are the number one method by which fraud is detected globally, establish confidential reporting channels (like hotlines or online portals) for employees, vendors, and customers to report suspicious activity. Publicise these channels and assure everyone that reports will be taken seriously and investigated. Make reporting easy and, if possible, anonymous. According to the ACFE, 43% of fraud cases are caught by whistleblower tips – more than three times the rate of detection by audits. By having a strong whistleblower programme, executives can significantly boost the chances of stopping an embezzlement early.

4. Leverage Technology for Monitoring:

Invest in fraud detection tools such as data analytics software and continuous monitoring systems. Automated systems can continuously scan transactions and flag anomalies or high-risk patterns in real time. For example, if an employee suddenly starts processing abnormally high expenses or if payments are being made to an unrecognised account, the system can alert management immediately. Many companies still rely on manual processes that are not sufficient against sophisticated schemes. Automation and data analytics act as a critical backstop, catching what human oversight may miss.

5. Training and Awareness:

Provide fraud awareness training to employees and managers. Educate staff about common schemes (such as invoice fraud, payroll fraud, or cash skimming) and the red flags to watch for – including the signs outlined in this report. Ensure that managers know how to respond if they suspect fraud: they should report to a designated internal authority rather than investigating on their own, which could tip off a perpetrator or compromise evidence. The more eyes are tuned to spot unusual behaviour or transactions, the safer the organisation will be.

6. Have a Response Plan:

Despite robust prevention efforts, fraud may still occur. It is crucial to have a response plan ready. This should include steps like: immediately isolating the suspected perpetrator from financial systems, securing relevant records and IT logs to prevent destruction of evidence, engaging a forensic audit team promptly to investigate, and notifying legal counsel and (if appropriate) law enforcement. A swift and structured response can limit losses and improve the chances of recovery. Planning for this scenario in advance ensures that if the alarm bells ring, the organisation isn’t left scrambling – it can act decisively and in a legally sound manner.

By taking these measures, executives create a multi-layered defence against embezzlement. No single control is foolproof, but together they significantly lower the risk. Importantly, leaders should regularly re-evaluate and update their fraud prevention strategies, especially as new threats emerge. High-profile incidents continually remind us that complacency is dangerous – staying vigilant and proactive is the best strategy. As one expert noted, “Fraud is now a core business risk and there’s no room for errors or loopholes”. In practice, this means companies must continually shore up their defences, use technology wisely, and maintain a culture where doing the right thing is non-negotiable.

Conclusion

Embezzlement can strike any organisation – from a lone employee siphoning petty cash to an executive diverting millions – and it thrives on gaps in oversight and trust. The damage goes beyond immediate financial losses; unchecked internal fraud can undermine morale, cripple finances, and tarnish a company’s reputation. The lessons are clear: vigilance and robust controls are non-negotiable.

Forensic audit trails provide a powerful means to uncover and address such wrongdoing. By literally following the money, organisations can identify not only who and how much was involved in a fraud, but also understand how the scheme worked and where internal controls failed. Our case study showed that even a severe embezzlement crisis can be overcome when leaders commit to a thorough investigation and transparent corrective action.

Ultimately, executives should treat anti-fraud measures as an investment in the company’s sustainability and integrity. A combination of preventive controls, a culture of ethics, employee awareness, and readiness to investigate suspicions dramatically lowers the risk of embezzlement. In an era of increasingly sophisticated fraud tactics, staying vigilant and proactive is essential. “Follow the money” is more than a catchphrase – it is a mindset for ensuring accountability. By embracing that mindset and strengthening audit trails, corporate leaders can protect their organisations’ assets and uphold the trust placed in them by stakeholders.

Sources:

- sanctions.io – What Is Embezzlement? Definition, Examples, and Legal Impact (2023)

- Corporate Compliance Insights – Warning Signs of Embezzlement & Practical Internal Controls (2024)

- Duja Consulting – Using Forensic Audits to Protect Shareholder Value (2023)

- Safe and Sound Security – 50 Alarming Employee Theft Statistics (2025)

- ACFE Insights – The Power of Forensic Accountants in Uncovering Fraud (Jan 2025)

- David & Associates – Top 7 Forensic Audit Techniques for 2024 (Dec 2024)

- Duja Consulting – Case Study: EOH – A Forensic Audit-Led Turnaround (2020)

- CAQ & ACFE – Occupational Fraud 2024: Report to the Nations (2024)

- Help Net Security – Overconfident Execs Vulnerable to Fraud (Feb 2025)